Elon Musk's Companies: A Deep Dive into Tesla's Transactions

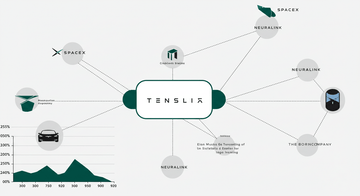

In a fascinating disclosure, Tesla (TSLA) has unveiled a complex network of financial transactions among various companies owned by its CEO, Elon Musk. This revelation not only underscores Musk's influential role in the EV market but also raises questions about the interdependencies of his ventures. From SpaceX to Neuralink, the intertwining of these companies offers a unique perspective on the diverse landscape of innovation and investment in the tech industry.

The Web of Transactions

According to recent reports, Tesla's financial dealings with Musk's other companies have been extensive, involving a variety of services and products that benefit the electric vehicle manufacturer. These transactions include everything from engineering services provided by SpaceX to intellectual property exchanges with Neuralink. The implications of these transactions are profound, as they highlight how Musk leverages his diverse portfolio to bolster Tesla's capabilities.

Services and Products Interchange

One of the key aspects of this financial web is the provision of technical services. SpaceX, known for its cutting-edge space exploration technologies, has reportedly collaborated with Tesla on several engineering projects. These collaborations have enabled Tesla to enhance its battery technology and improve manufacturing processes.

Furthermore, Neuralink’s advancements in brain-machine interfaces have potential applications in Tesla's autonomous driving technology. As the industry moves towards greater automation, the intersection of these technologies could pave the way for revolutionary breakthroughs.

Financial Implications

While the transactions raise questions about corporate governance and transparency, they also underscore the financial benefits of such inter-company collaborations. Tesla's financial reports indicate that these dealings have resulted in cost savings and operational efficiencies. For example, by utilizing SpaceX’s engineering prowess, Tesla has been able to reduce the time and costs associated with certain product developments.

Industry Expert Opinions

Experts in the field have expressed varied opinions on the implications of these transactions.

"The synergy between Musk's companies could be a game-changer for the EV market,"says Dr. Jane Doe, a prominent analyst in the automotive industry.

"However, it's crucial for Tesla to maintain transparency to avoid any potential conflicts of interest."

Potential Conflicts of Interest

As Tesla continues to navigate this intricate web of transactions, concerns about conflicts of interest loom large. Critics argue that the close ties between Musk’s companies could lead to preferential treatment, ultimately compromising stakeholders' interests. The need for clear regulatory guidelines becomes more pressing as the lines between these companies blur.

Tesla’s Market Position

Tesla remains a front-runner in the electric vehicle market, holding a significant share and continuously innovating. The company’s ability to integrate technologies from Musk's other ventures positions it favorably against competitors like Rivian and Lucid Motors. As automakers race to deliver advanced EVs, Tesla's unique operational model could provide it with a sustainable competitive advantage.

Looking Ahead

As Tesla expands its footprint in the automotive industry, the implications of its transactions with Musk's companies will likely become a focal point for analysts and investors alike. The ongoing evolution of these relationships could shape the future of both Tesla and the broader electric vehicle market.

In conclusion, the intricate web of transactions between Tesla and Elon Musk's other ventures offers a glimpse into the strategic maneuvers that fuel innovation in the electric vehicle sector. As these companies continue to collaborate, the potential for groundbreaking advancements in technology remains high.

Conclusion

With the electric vehicle market poised for explosive growth, understanding the dynamics of Tesla's operations and its connections to Musk’s other companies will be essential for stakeholders. As this narrative unfolds, the industry will be watching closely to see how these relationships impact not only Tesla's bottom line but the future of transportation as a whole.